EIA

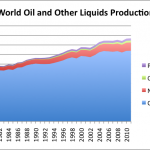

The EIA, unlike the IEA, has been strident in its dismissal of peak oil. But the data that the EIA publishes tells a very different story than the one it wants us to hear. Gail the Actuary has a really good analysis up at the Oil Drum.. The essential message - that crude oil production remains basically flat, as it has since 2005, and that growth in non-crude "liquids" (all those things that have made up for the lack of crude growth in world demand) aren't growing as fast as desired or predicted.

Among the critical takeways - that unconventional oil production probably will cease to keep…

Far be it from me to laud cuts in spending on critical things like energy analysis...but I admit I can't work up a good head of steam about the cuts in the EIA budget. After all, the EIA has managed to consistently get it wrong on oil reserves. Here's what happened:

The final fiscal year (FY) 2011 budget provides $95.4 million for the U.S. Energy Information Administration (EIA), a reduction of $15.2 million, or 14 percent, from the FY 2010 level.

"The lower FY 2011 funding level will require significant cuts in EIA's data, analysis, and forecasting activities," said EIA Administrator…