I've written before about how the Collapse of the Jenga of Shit (aka the 'subprime' loan crisis) has raised the price of borrowing money--which is paid for with higher state and local taxes--due to the collapse of bond insurers and a liquidity crisis in municipal bonds. Now your property and sales taxes can take another hike courtesy of ratings agency like Standard & Poor's, Moody's Investors Service, and Fitch Ratings. From the New York Times (italics mine):

If they are right, billions of taxpayers' dollars -- money that could be used to build schools, pave roads and repair bridges -- are being siphoned off in the financial markets, where the recent tumult has driven up borrowing costs for many communities.A complex system of credit ratings and insurance policies that Wall Street uses to set prices for municipal bonds makes borrowing needlessly expensive for many localities, some officials say. States and cities have begun to fight back, saying they can no longer afford the status quo given the slackening economy and recent market turmoil.

Municipal bonds, often considered among the safest investments, sank along with stocks last week, darkening the already grim mood in the markets. Several big hedge funds unloaded bonds as banks further tightened credit to contain the damage from mounting losses on home mortgages and other loans.

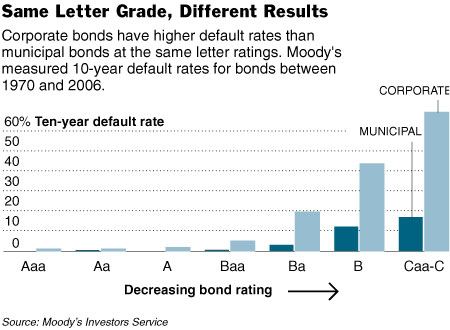

States and cities rarely dishonor their debts. The bonds they sell to investors are generally tax-free and much safer than those issued by corporations. But some officials complain that ratings firms assign municipal borrowers low credit scores compared with corporations. Taxpayers ultimately pay the price, the officials say, in the form of higher fees and interest costs on public debt.

"Taxpayers are paying billions of dollars in increased costs because of the dual standard used by the rating bureaus," said Bill Lockyer, treasurer of California, who is leading a nationwide campaign to change the way the bonds are rated. California, one of the largest issuers of municipal bonds, is rated A; Mr. Lockyer said the state should be triple A.

The state is soliciting support from other municipalities for a letter it intends to send to the ratings agencies, arguing that municipal bonds should be rated on the same scale as the one used for corporate bonds.

Because of their relatively weak credit scores, more than half of all municipal borrowers buy insurance policies that safeguard their bonds in the unlikely event that they fail to pay the debt. California, for instance, paid $102 million to insure more than $9 billion in general obligation debt between 2003 and 2007.

Ratings agencies like Standard & Poor's, Moody's Investors Service and Fitch Ratings are paid a second time to evaluate the insured bonds.

Lookee! A picture:

What's really absurd are the defenses of this practice. The most ludicrous argument is that municipal bonds have to be rated more strictly than corporate bonds because most municipal bonds are so good, it's hard to tell them apart. It's the "Graded on a Curve" defense. Or maybe it should be called the Soft Bigotry of Low Corporate Expectations....

Not only is the taxpayer getting the shaft, along with schools, parks, museums, and other public services, but this also distorts the value of municipal versus corporate bonds: corporate bonds are overvalued, while municipal bonds are undervalued. In an indirect way, this is an involuntary, undemocratic subsidy of corporate capital raising by state and local governments, simply because a private ratings agency says so.

And if you're wondering why I bring this up, this is the context in which funding of science education happens.

it doesn't help when cities try to inflate their ratings (with the collusion of the banks)

http://www.sandiegoreader.com/news/2005/jan/06/conspiracy-deliberate-ig…

Long story short: San Diego wants to buy a ballpark for its baseball team using municipal bonds, but doesn't want to disclose that it has been underfunding its pension fund. Solution: find a bank that will keep details of the transaction confidential, in return for which the bank gets to charge the city junk bond rates and fees on AAA rated, insured, non-taxable bonds.

Overall I think the main reason that cities are charged more for bonds is because the incentives (clout, favors, side deals) for the politicians involved in municipal finance are very different than the incentives (performance based year end bonus) for the people involved in corporate finance.

Actually its backwards. The disappearance of muni insurance is a silver lining. Investors wanted AAA paper and the whole rating / insurance scheme was basically rent-seeking that imposed unneccessary costs on the whole system. CA and other issuers are taking the lead in bringing new issues to market without the unneccessary insurance.

bwv,

The disappearance of insurance is a good thing, as long as munies are rated accurately. I agree: hopefully, CA (and CT) will change both components.

thanks

That's just it bwv, insurance isn't going to disappear, and with this Obama-care thing, we are going to be forced to have health care. Its quite unconstitutional.