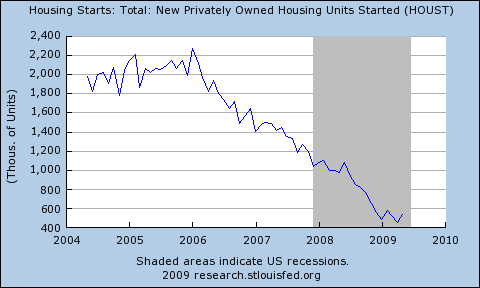

Recently, I described how absurd it is to get excited over the second derivative when it comes to unemployment. A decrease in the rate at which unemployment is increasing is hardly good news (it beats the alternative, but "green shoots", this is not). Now, we're hearing similar noises about housing starts (building of new houses): they're increasing, we must be doing better! Admittedly, this is a gain--the first derivative. But Paul Krugman, using a really nifty St. Louis Federal Reserve site, puts this in context:

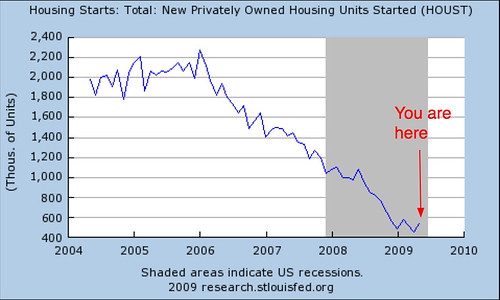

Let me help, just in case you missed it:

A seventeen percent increase in jack shit is still jack shit--there's a difference between percent change and absolute numbers.

Maybe this is good news--I certainly hope so. But this could also be the occasional jump as the water swirls around the bowl. Because it's not like a whole lot of ARMs are going to recast in about 16 months or anything....

Also, starts are a very noisy series--month to month movements are almost meaningless. You really need to see a few months to start to see a trend.

AHAHAHAHAHAHAHHA! Good one, holmes!

To play devil's advocate (just a little), maybe this is being trumpeted as good news because it may have some positive consequences? Sure, this could just be noise in the data, but the idea that home ownership is on the rise may lead to increased consumer confidence, and in turn, economic improvement.

Aren't there too many houses on the market already? How is building new houses going to help?

biber hapı

penis büyütücüleri

may have some positive consequences? Sure, this could just be noise in the data, but the idea that home ownership is on the rise may lead to increased consumer confidence, and in turn