I do so wish we still had Democrats who bring the righteous thunder instead of sounding like mealy-mouth technocrats (although "Satan-sandwich" was kinda funny). Sadly, you're stuck with me instead.

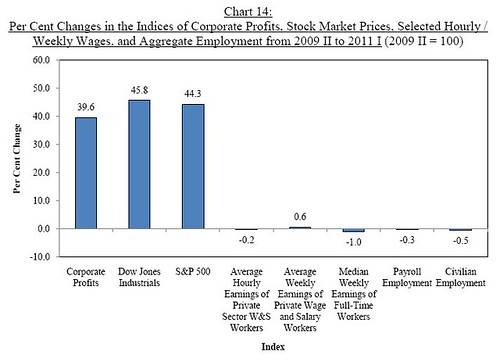

Anyway, by way of Bill Mitchell, we come across a report (pdf) that has the rather dry title of "The "Jobless and Wageless" Recovery from the Great Recession of 2007-2009: The Magnitude and Sources of Economic Growth Through 2011 I and Their Impacts on Workers, Profits, and Stock Values." But I assure you it tells a story that will raise your blood pressure. While there are a couple 'abused graphs' in the report, this one lays out clearly what has happened during the last two years:

In a nutshell (and how much economic analysis fits in a nutshell, by the way?), between 2009-2011, corporate profits, in real dollars, increased forty percent. And wages? Not so much: essentially zero wage growth and zero change in employment.

So you see, we're doing great! I guess this is that whole 'shared sacrifice' thing everybody talks about: the wealthy sacrifice you, and then share bits of you with their friends.

Or something.

Seriously, you would think people would be angry about this, and lash out at the appropriate parties, not the needy. Unfortunately, too many believe they will find favor, that they are among the righteous if they kiss the whip hand.

This discrepancy is why so many people's lives are less than what they hoped for, why they are so angry. Cutting Social Security, Medicare, not to mention discretionary spending won't fix this. Empowering workers will, and a good way to do that is to tighten labor markets by putting people to work.

The graph you present must be one of those abused graphs. It is apparently comparing the bottom of the stock market crash to present market values. The S&P 500 is very volatile and should not be compared to wages. That 40% gain from 2009 is very misleading. If you look back to July 2008 the S&P is up only 4%, and if you look back to July 2007 the S&P is down 11%.

I agree that banks have made out like bandits the last 3 years, but that graph is really not an honest representation of the problem.

Yeah, I have to agree with #1 on this graph. It is like climate deniers picking a point and extrapolating. Show the last 5 years and something quite different appears. Or use a running average or something.

@1 & 2:

As one of the workers, I must say: Your considered remarks make me feel so much richer.

Unfortunately, degree of accuracy aside, the graph reports the same exact thing my eyes see. Corporations have a thing about making more money this period than last, regardless of how well they did. With money supply roughly stable, where do YOU think those ever-increasing profits are going to come from? When we are finally sucked dry I fear it will get ugly.

"The graph you present must be one of those abused graphs. It is apparently comparing the bottom of the stock market crash to present market values"

So?

The picture is that the stock market recovered well but the wages of the people doing the actual production have reduced even further.

Furthermore, using the stock market portion of the graphic as the ONLY area to compare is would be misleading. This graphic includes three different areas of corporate statistics to provide a wider area of reference so as to buttress the overall point.

As to the complaint regarding use of statistics only from the bottom of the crash would only be relevant if the same statistical period for wages and employment were used as well. Any bets that by doing so wage earners would be shown as coming off even worse than in this graphic?

Graphs don't make people angry --- people make people angry. Just this morning, I watched Keith the Mad Olbermann unleash his vocabulary at the data bars on the left (ironic isn't it?) in the service of stirring up the masses--or at least the ones who know what "mountebank" means. For anyone interested:

http://current.com/shows/countdown/videos/special-comment-the-four-grea…

Matthew 25.29

"For everyone who has will be given more, and he will have an abundance. Whoever does not have, even what he has will be taken from him."

Maybe Obama doesn't want to tax the rich, but the markets will do it for him. BNY is going to charge for holding high cash deposits (due to the costs of insuring them). This is not 2008. It's not about funding. It's about the cost of credit risk. Money's out there, but the rich don't want to invest it. They want to keep it safe. But there is not enough safety to go around, so they'll either be charged a hefty premium for keeping it safe in a bank vault, or have to invest it in the market -- hence, create jobs and stimulate growth.

I am in agreement with #1, the timeframe chosen is extremely important and can easily be manipulated by chosing the period you require to fit your position. What if we looked at this same chart from the 2 years 2007-2009, we would see roughly a 60% decline in the value of the S&P as well as Dow, as well as profits declining significantly greater than the other measures in the chart. In fact, why even include the price change of the markets when they are driven so much by emotions?

If you believe certain companies are making too much money, why wouldn't you just buy them? They are public.

Also, the increase in the market valuation of these companies is a benefit to anyone who's got their pension savings invested in them. Is that bad?

Most of those shares are owned by rich people. The same rich people who are getting the benefits of increased bonuses while they're working.

So no.

re #10, you would also see the number of workers go down much faster. Of course, you still need a CEO and you need to pay MORE for them!

@Wow

"Most of those shares are owned by rich people."

Silly me, and I thought that anyone with a 401k owns shares indirectly.

And those shares are divvied up amongst a LOT more people.

Or is everyone getting the shares of everyone else?

@Wow

Regardless of how much other people own, if I - a middle class guy - make $10,000 towards my retirement, is it good or bad for me?