By way of archcrone (via skippy), I came across this McClatchy article which discusses the massive inflation in food prices:

The Labor Department's most recent inflation data showed that U.S. food prices rose by 4.1 percent for the 12 months ending in June, but a deeper look at the numbers reveals that the price of milk, eggs and other essentials in the American diet are actually rising by double digits.Already stung by a two-year rise in gasoline prices, American consumers now face sharply higher prices for foods they can't do without. This little-known fact may go a long way to explaining why, despite healthy job statistics, Americans remain glum about the economy.

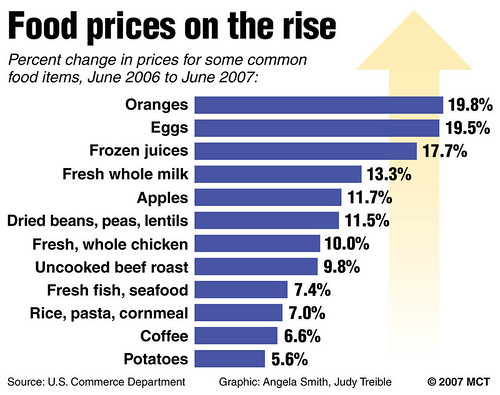

...The Bureau of Labor Statistics said in its June inflation report that egg prices are 19.5 percent higher than they were in June 2006. Over the same period, according to the department's consumer price index, whole milk was up 13.3 percent; fresh chicken 10 percent; navel oranges 19.8 percent; apples 11.7 percent. Dried beans were up 11.5 percent, and white bread just missed double-digit growth, rising by 9.6 percent.

These numbers get lost in the broader inflation rate for all goods and services, which measured 2.7 for the same 12-month period. Across the economy, rising food prices were offset by falling prices for things bought at the mall: computers, cameras, clothing and shoes.

"All of that stuff is going down in price, but prices for gasoline have gotten higher, and food prices have gone up," said Mark Vitner, a senior economist for Wachovia, a large national bank based in Charlotte, N.C.

Here's what things look like:

Why is this happening? Lots of reasons:

It's partly because of corn prices, driven up by congressional mandates for ethanol production, which have reduced the amount of corn available for animal feed. It's also because of tougher immigration enforcement and a late spring freeze, which have made farm laborers scarcer and damaged fruit and vegetable crops, respectively. And it's because of higher diesel fuel costs to run tractors and attractive foreign markets that take U.S. production....

Globalization also explains higher milk prices. Australia, a leading milk exporter, is struggling through a drought, and European governments are pulling back dairy subsidies. So U.S. farmers, aided by a weak dollar, are stepping in to meet growing demand for milk products in China and India. That's pinched supply at home and abroad, driving up prices.

And what does Little Lord Pontchartrain think about it:

Meeting with economic writers last week, President Bush dismissed several polls that show Americans are down on the economy. He expressed surprise that inflation is one of the stated concerns.

"They cite inflation?" Bush asked, adding that, "I happen to believe the war has clouded a lot of people's sense of optimism."

Well, the war has clouded "people's sense of optimism." But paying a lot more for food just might have something to do with clouding "people's sense of optimism" too.

Let them eat "computers, cameras, clothing and shoes."

Not to be dogmatic, but inflation is solely a function of money supply. Increases in the price of a commodity, in the absence of an expansion of the money supply will not lead to inflation. The increase in food prices will be compensated for elsewhere in the budgets of consumers. As you said, it in effect reduces their take-home incomes so that either they will find substitutes or reduce consumption in other areas. The first and most obvious area would be discretionary purchases such as electronics.

(although perhaps in reality they will just go further into debt).